Tag Archives: International Taxation

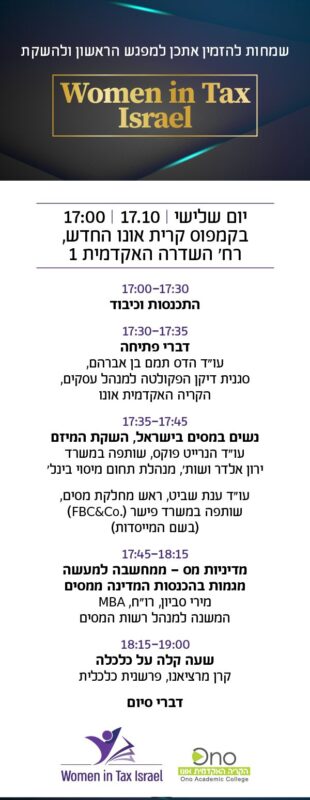

REGISTER FOR THE ISRAEL WOMENS’ TAX EVENT OF THE YEAR

YEtax has co-founded the not-for-profit initiative Women In Tax Israel, and it’s first event will take place on October 17, 2023. The launch will be a gathering all women in tax both in government as well as in private service. For more details about the initiative or the launch event please contact Advocate Henriette Fuchs

Register to THE EVENT HERE

YEtax Conference May 2023

You’re Invited! Join Us for the YEtax Conference Event

Participation is by registration only

For any inquiries, kindly email: dikla@yetax.co.il

Register FOR THE EVENT HEREOpening words by Adv. Tali Yaron-Eldar, YEtax Managing Partner.

Followed by a superb line-up of speakers, each a leader in their respective field:

Adv. Rany Schwartz, YEtax Founding Partner

🗸 Do The Right Thing – Tips for dealing with taxation for entrepreneurs

Adi Bar, CEO of BE International

🗸Challenges & Solutions in Global Entrepreneurship

Adv. Amit Gottlieb, Yetax Partner

🗸 When Entrepreneurship Meets Trusts

Mr. Uri Aldubi, Chairman of Phoenix Value

🗸 The Founding of Pollosano Start-up

The event will be conducted in Hebrew

For any inquiries, kindly email: dikla@yetax.co.il

Do not register Israel owned patents on foreign group companies, unless the group is ready to pay millions of dollar $ in tax

On June 1, 2023, the District Court delivered its’ decision in the dispute of Medtronic Venture Technologies Ltd with the tax assessor.

Nearly two years after the US based Medtronic Inc company had completed the acquisition of full control in Medtronic Israel (in 2009) for approx. 326 M US$, Medtronic Israel had awarded a license to a Medtronic group company in Ireland to use its’ intellectual property, while a second agreement was signed by which Medtronic Israel would provide R&D services to related companies under a cost-plus compensation, taking effect already in 2009. In 2012 the Israeli entity terminated its activities.

The tax assessor believed intercompany agreements in the case at hand in fact signified a transfer of functions, assets and risks (“FAR”) pivotal to the activities of the Israel based company. And therefore, the tax office had deemed the constellation of events a tax relevant sale of business assets and capabilities, not in the least because the company ceased its activities a bit over a year later.

The Medtronic Israel company had filed an appeal to court, arguing inter alia, that the tax assessments should not be upheld under the statute of limitations, that the tax assessor had not (sufficiently) motivated his position and had misrepresented the transactions by wanting to see the fleeing of assets and business functions abroad ~ within the group.

The Court agreed with the tax assessor that under the arm’s-length principles (also of section 85A to the Israel Income Tax Ordinance) and the relevant ‘re-organizations chapter’ of the OECD transfer pricing guidelines, that company had been left a hollow barrel. The facts in this case were different from the Broadcom decision, because no increase of Medtronic’s personnel or capabilities in Israel had materialized after the acquisition and the re-registration of patent ownership on other Medtronic group companies, which patents had previously been registered in the name of the Israeli company proved that industrial know how had been lifted out of Israel and ‘planted’ with Medtronic Inc without any or sufficient payment by the new owners of these assets.

In the previous cases of Broadcom and Medingo, the IP had remained with the Israeli company and continued to have a separate and independent value of its own.

Business dealings without a written agreement contradict how the Medtronic group would interact with third parties, the judge said. This is especially true for a “dinosaur,” as the CEO of Medtronic Israel characterized the large and old Medtronic multinational, he ruled. Medtronic had not succeeded in proving, explained the court, that the intercompany agreements were a mere reflection of group policies and that the late drafting and signing of the relevant intercompany agreements did not plea for proper business behaviour. The court also did not accept a downward adjustment of the income assessed resulting from the “transfers”, and which income had been determined by the tax assessor as a function of the acquisition price of the shares of the company at 326 M US$.

Note that the court, also on this occasion, confirmed the tax authority’s “secondary tax adjustment” (like the court had in the similar Giteck case) by adding interest income on the amount of the underpayment by relevant foreign group companies for the FAR extracted from Medtronic Israel. The reasoning for the interest income addition was that an independent party would have never waived an interest charge on the debt of the relevant companies.

The court dismissed the appeal, upheld the tax assessments and charged the company with NIS 180,000 (US$ 45,000 approx.) for the recovery of expenses run up by the tax authorities (link to the decision).Note that in the case of Medingo, the same court had decided in favor of the local Israel company which – after it had been acquired by the Roche pharmaceuticals multinational – it had properly managed the intercompany relations supported by solid agreements, had shown an increase in turnover and personnel post-acquisition (see here).

There are many suitable ways for both acquiring and shaping the co-operation of a newly acquired Israel technological company with other companies and functions in an international Group.

Crypto Tax and Digital Assets

Initiatives taken by the Israeli government regarding the taxation of digital services and the trading of digital assets

Israel’s proposed Budget Law 2023–24 shows the new government is rolling up its sleeves to get to work on the tax front.

The tax proposals, inter alia:

- Encourage a more affordable housing market by limiting tax breaks on residential property;

- Combat improper conduct regarding VAT receipts;

- Force partial payment of tax debt, although an appeal is pending in court;

- Limit the amount of cash used for transactions; and

- Cancel the 0% VAT benefit for tourism-related services and hotels.

Other significant proposals seek to cut a tax slice from, and to regulate, digital business; create a VAT charge on certain digital services offered by foreign providers; and find ways to tax income from, and regulate, digital asset dealings.

VAT registration obligation for foreign B2C digital service providers

The Israeli government has proposed an amendment to the Value Added Tax Law, 1975, in an effort to facilitate the collection of VAT on digital services purchased by Israel residents from foreign suppliers.

Today, the responsibility for the payment of the 17% VAT, on incoming services from non-resident businesses, rests on the Israeli resident recipient. The amendment seeks – in line with the OECD’s developing plans and recommendations – to obligate those non-resident service providers to register in Israel and charge, collect and pay VAT. The creation of a VAT registration obligation for non-residents was first proposed in 2016, and appeared in several other legislative proposals, none of which made it to the finish line.

The creation of a VAT charge on incoming digital transactions should first and foremost neutralise the perceived ‘economic discrimination’ of local businesses providing similar services and that charge VAT to their local customers. But an expected income of $100 million in 2023 – and then of about $140 million each following year – is an interesting forecast for the treasury in Jerusalem.

The memorandum of the proposal of law explains that a digital service is a “service provided through the internet or by other electronic means, allowing brokerage for service providers and the sale of intangible goods, including visual or audio content, remote teaching, entry and use of applications, authors content, games etc”. Television, broadcasting services and services provided by the transfer or receipt of signals, words, sounds, images, etc. through a fibre optic cable, radio transmission or other electromagnetic system would also fit the bill.

VAT on services to VAT-registered businesses, NGOs and financial institutions can already be self-reported (by reverse charge) and paid by these entities. The disadvantage for the last two types of organisations is that they are not eligible to offset the input VAT they charged themselves and it becomes a hefty cost.

The bill does not yet specify the manner of registration or reporting. The Minister of Finance shall set out, in new regulations, how foreign VAT-registered businesses registered in the special foreign providers registry should act, manage records and retain documentation for at least seven years (including data regarding the service provided, presentable within 30 days upon demand by the tax assessor).

The plans shall come into effect the moment that legislation is accepted and published as law by Israel’s parliament, unless the law indicates a specific date and any grandfathering rule. The draft will definitely incur some changes in the last legislative phase now before us.

A framework to enforce tax on digital assets

The draft bill presents a framework for the organising of, and infrastructure pertaining to, digital assets and their trading, including regulatory, security and banking law.

The proposal classifies ‘digital currencies’ as assets for the purpose of income tax and VAT law. The profit on a sale or an exchange of a virtual currency is subject to gains tax at a 25% rate. Non- and incorrect reporting can trigger criminal proceedings and penalties.

The draft law prescribes, inter alia, how the historical cost price and date of purchase of a digital asset must be determined, and defines the ‘location’ of an asset. The latter is pivotal for tax, as domestic- and foreign-held assets result in different Israeli tax rules for different types of taxpayers. The sale of digital assets executed through supervised and licensed entities would be subject to withholding tax and if the appropriate tax has been charged at source, the taxpayer is discharged from further reporting. Resident taxpayers would have to disclose to the authorities when their digital assets are worth more than ILS 200,000 (approximately $52,000) if they are not held through a qualifying ‘supervising entity’ on a regulated platform.

The Bank of Israel might create a bank account to which taxpayers could transfer tax due. Today, the payment of tax by a willing taxpayer is a difficult chore; banks in Israel will often not accept transfers that originate from crypto activities, for fear of money laundering. In connection with this, the Supervisor of Banks is to create infrastructure for reporting, to monitor the issuance of licences to entities wanting to facilitate trading in digital assets and to determine whether a bank is rightfully refusing the opening of an account or a transfer.

The draft bill wrestles with decentralised autonomous organisations (DAOs, which are comparable to partnerships) and an inter-ministerial committee will be appointed to establish the corporate and legal status of DAOs and their proper taxation.

The Supervisor on Financial Service Provision would be given the authority – under the Control on Financial Services Law – to license (foreign) entities wanting to provide services, provided they meet all the (new) conditions. A foreign service provider requesting a licence must also convince that it offers adequate protection against financial risks (bearing in mind recent international crypto thefts) and comply with Israel’s Prohibition on Money Laundering Law. The government has also published an intention to create infrastructure for services pertaining to backed digital assets.

Not only does the proposal ensure regulatory oversight and financial protection, but the constellation of legislative proposals surrounding digital asset trading may actually encourage foreign players to offer digital asset services in Israel.

The final text of this proposal will be before parliament for approval on May 29.

Crypto & Digital Trading heading in a good direction

All in all, Israel may be taking excellent steps to ease crypto trading out of the corner it has been in, but also in opening its borders, which will surely benefit the economy of Israel, a proven leader also in blockchain technologies.

Read original publication on world tax siteJanuary 20, 2023

Reduction on Withholding Tax in Israel

When a foreign resident generates income in Israel, the payor of the income will in principle have to charge tax at source of 25%. In the strict maintenance of the imposition of withholding tax on outgoing payments Israel holds a somewhat unique position, as the enforcement largely rest on the banks in Israel transferring money out.

Depending on a Convention for Prevention of Double Taxation, the Israel tax officer may issue – upon request and Forms filed – a certificate for reduction of that withholding tax, or an exemption, under Regulation 2 of the Income Tax Regulations (“deduction from payments to foreign residents”). Although these regulations specifically only refer to payments of income which qualify as “taxable” under sections 170 and 171 of the Israel Income Tax Ordinance, Israeli banks will insist, for most money transfers, the tax assessor’s approval for an exemption or reduction of withholding tax.

Automatic Exemption from Withholding Tax on Certain Payments – Executive Order 34/93

The Israel Ministry of Finance, with the understanding that the process for having to obtain withholding tax permits is burdensome and sometimes counter-productive for Israel’s trade relations, included in its executive order of 1993 (34/93) a listing of specific transfers to recipients abroad which do not require withholding tax and which do not require a withholding tax certificate from the tax assessor.

These payments can be made based only on the tax payer’s declaration in a form and includes all details required in the said form and it will be noted on it, or on a copy of it, as a ‘statement for tax purposes’. The list of payments of which the transfer to a foreign resident is permitted without the charge of any tax at source is:

- Purchase of tangible goods (with the exception of computer software which often may contain a royalty element in relation to a “right of use”, which is subject to withholding tax)

- In that case the import list will suffice, without the need for the payer’s state- ment. Also the documents required by the supervisor of foreign currency as proof of import for making payments on account, without the payer’s state- ment, provided that the import list is attached to the last payment.

- It may also suffice to deposit payer’s statement as a reference, without the need for a list of import, regarding the import of goods of which total value does not exceed 500 dollars, provided that the payer has declared that this import is not in the scope of his business or responsibilities.

- Correspondent fees for banks abroad, without a statement by the payer’s.

- Land, sea and air transport services, carried out in their entirety abroad

- Port services, unloading, loading and storage abroad, including payments to customs agents abroad.

- Services provided to Israeli shipping and aviation companies, operating on international routes, with the exception of payments for services in Israel

- International shipping or aviation services, performed by a resident of one of the countries with which Israel has a valid (tax) agreement on this matter,

- Tourism services performed entirely abroad.

- Insurance abroad to cover risks abroad.

- Services provided and performed in full abroad by foreign service providers, including agents, on condition that the payer declared that no one was in Israel to perform the services, and on the condition that the total payment for these kinds of services in the tax year, by that specific payer, does not exceed $250,000

- Refund of an advance to a foreign customer, provided it does not include interest and does not exceed the amount of the advance

- Fees for patent registration, standards inspections, company registration, etc., to authorized authorities abroad

- Obligatory payments to governmental authorities abroad upon demand

- Subscription fees for journals published abroad

- Membership fees for an international organization abroad.

- Entrance or participation fees for a foreign seminar, conference or exhibition

- Foreign advertising expenses.

- Fees for a booth at a (foreign) exhibition.

- Fees for participation in a foreign tender abroad.

- Tuition, registration fees, exam fees, etc., paid to educational institutions abroad

- Proceeds of a real estate sale, provided a certificate from the Real Estate Tax office was received

- Acquisition of provident/pension rights from a foreign country or institution

- Certain allowances to foreign residents under various social laws and regulations

- Allowances – according to a document on behalf of the payer (including a credit notice), detailing the nature of the credit as a pension or as an annuity and/or the pension slip, within the limit of the amount specified in the document

- Bequests – based on an inheritance order and/or court approval regarding the estate, within the limit of the amounts attributed to the heirs abroad

- Alimony paid according to law.

- Certain gifts and supports for relatives

- Allowance for medical travel and expenses for medical treatment abroad

- Redemption of State of Israel bonds (bonds).

- Proceeds from sale or redemption securities Tel Aviv Stock Exchange.

- Consideration for the purchase of a foreign security.

- Proceeds for a single sale of a privately owned vehicle

- Transfers to the recipient who is an individual in an amount not exceeding $500 per year for the payer.

- Transfers from a non-resident deposit account to a non-resident deposit account

The formalities and requirements surrounding withholding tax in Israel may cause complications in commercial transactions and cross-border monetary traffic. For solutions feel free to contact us here

YEtax Partner Rany Schwartz talks VAT Taxation

Duns100 Interviews Partner Rany Schwartz on VAT Taxation issues. The below is a translated transcription of the original online Hebrew publication 2.08.22

Listen to the podcast (in Hebrew) hereProblems involving taxes can be an expensive matter. What can cause these kinds of issues?

No one likes being audited. Even if you’re certain you’ve operated entirely above board, when someone actively looks for issues they’re likely to find them. Sometimes these are just small deviations, but often we’ll discover that we’ve been operating long-term in a way that, in hindsight, turned out to be problematic. Whether this is the result of poor advice or just an innocent mistake, it’s liable to cost us a lot of money – this is essentially an opportunity for the tax authorities to collect money that belongs to the State.

How does the VAT system work?

I collect value added tax (VAT) for the State, hold it, and then transfer it to the tax authorities. After that, any retroactive claims by the authorities can result in a considerable deficit on my part, since I’ve already spent that money.

Our experience allows us to identify the major flaw in this method: you can’t truly know who you’re doing business with. Generally, we don’t have the ability to do comprehensive due diligence, which that means we need to be very cautious. For example, if I work with a vendor and know they are in financial straits, what’s most important to me is understanding that if I pay them for services rendered, I must be certain they transfer that VAT.

Even after I’ve already paid the VAT to them?

That’s exactly the point, it’s input VAT! I paid VAT to the vendor out of my own pocket in order to receive a service, and in turn they must pass that VAT on to the tax authorities. If they haven’t done so, I am expected to pay an indemnity to the State. While it is possible to defend against these charges in some cases, it isn’t in others. It depends whether I made a point of looking into the client or vendor beforehand – whether or not they are a registered business, who is receiving the service. Invoices must be issued only to the service recipient, not the payer. Otherwise, the tax authorities can label them fictitious invoices. This term has lost a lot of its meaning!

My first tip, whether you’re providing or receiving services, is to know who you’re doing business with, determine if they are the appropriate vendor and what their circumstances are.

What else can create VAT problems?

Here’s another common example: it may turn out, after the fact, that an invoice issued for services provided lists the details of a licensed dealer that are not those of the vendor itself.

Why does this happen?

It may be that the vendor wants to provide a certain service but has not licensed to do so due to some sort of limitations. They may use external companies that “assist” by providing invoices on their behalf – at best, this practice is a legal gray area; in extreme cases, they could be using fake invoices outright. You may ask, why should this concern me as the service recipient? In fact, the Supreme Court ruled that it is the responsibility of the service recipient to ensure that the issuer of the invoice is a licensed dealer. For instance, if someone provides me with an invoice issued by “Company X Ltd.” – who is Company X Ltd.? It is my responsibility to verify whether the person providing me with the service is authorized to do so.

What are other classic VAT pitfalls?

Is my transaction subject to regular VAT or is it VAT exempt? I, of course, assume that it’s a zero-rate VAT service. Why? Because I read it somewhere. I’m joking, obviously – but the fact is that it would be to my benefit to assume so since zero-rated VAT means I can reduce my prices by 17% and be more competitive. But what happens if it turns out afterwards that the service I provided was in fact subject to regular VAT? I’ll be forced to absorb that loss, since I can’t reasonably approach my customers and demand additional payment. Therefore, it’s prudent to thoroughly check the legalities.

Which businesses are at highest risk to be audited?

In terms of VAT fraud, the businesses involved are most often service-based and less frequently trade in goods. Two industries at high risk are human resources and construction services. When it comes to trade in goods, transactions on certain high-VAT goods may have a high number of fraudulent invoices – for example fuels and precious metals. Particular caution is needed when using a manpower service, such as a cleaning service. These need to be a serious part of the risk calculation for any contractor or dealer.

How can I lower my risk?

First and foremost, Work closely with professional advisers who provide good service. It’s not enough to just have a tax adviser or accountant that knows the law; you should have one that really guides you through every step and decision.

They should instruct and assist you with a high level of service and consideration, so you’ll be able to call on them at any time for advice on day-to-day dilemmas you encounter. The challenge is that many times people are more focused on doing successful business and less on the compliance. That’s why having an adviser available to keep track on those issues. Someone you can really depend on.

Second, do your homework and know what you’re dealing with. Launching a business is a responsibility that goes beyond simply waking up every morning and selling a product. You also a responsibility to maintain a bookkeeping system and understand how to use it, whether that means producing receipts and invoices in a timely manner or managing a computer system.

What should I check in tax invoices?

An invoice must be legally valid. That sounds simple, but here’s where it can become complicated: “legally valid” means both from a formally and substantively. Formally, that means the invoice must contain all the details required by law. First, you must have a licensed dealer number and contact information. Second, the invoice must be addressed to the recipient of the service or goods, including their official details as registered with the authorities. The invoice must contain full details of the nature and scope of the service provided in the transaction, or the types and quantities in the case of goods.

Substantively, the invoice must reflect the transaction between the parties actually providing and receiving the services, otherwise it is not legal, and therefore considered fictitious. This is dramatically significant.

Sometimes it’s just a matter of simple human error that ends up being labelled as fictitious, which seems like an overstatement.

To the average person, “fictitious” implies dishonesty or something that doesn’t actually exist. Obviously, there is a big difference between an intentionally fictitious, or fake, invoice and those that meet that legal definition. But in our professional sphere, invoices with errors are considered legally noncompliant and therefore fictitious. I’ll discuss the consequences of a flawed invoice that is determined to be illegal or fictitious. There is a range of outcomes, starting with the fact that the invoice cannot be used to offset the input taxes included in the transaction. Other consequences are more severe, including invalidation of the business’s books, which has much more significant financial consequences and possibly even criminal liability. After all, tax offenses are criminal offenses for all intents and purposes. As such, the consequences can be severe.

The State has created more and more systems for taxation. Obviously, it’s better to avoid problems. But if I did end up with a problem as a result of human error and discovered that I owe back payment on VAT, what could be done to manage the damage?

Let’s tackle this question in two parts.

In one scenario, let’s say this was the result of a bona fide mistake. Should you try to fight? Absolutely. It’s not the end and it is unequivocally worth the effort. The tax authorities often assume auditees will not fight the findings of an audit. The authorities’ goal is to recover as many taxes as possible, so they have a vested interest in interpreting any legal gray areas that turn up in the course of an audit in the most restrictive way possible. However, that does not mean the auditee must immediately accept their conclusions without question and pay. Legitimate differing interpretations of tax law are the basis for legal deliberations like these, and therefore there is little risk in appealing the conclusions in most cases. You can insist on your legal interpretation, and even if an assessment is issued, there’s no reason to panic. Assessments can be appealed, and failing that, an appeal as of right can then be issued to the district court, and the disputed taxes don’t need to be paid during this process.

My recommendation is not to give up, especially when it comes to legitimate civil disputes of interpretation.

On the other hand, these problems could be the result of poor judgement rather than an unintended mistake. Unlike the previous scenario, the auditee does have a lot at risk in this second scenario. Rather than just the taxes being at stake, the consequences now are much more severe sanctions, potentially even criminal prosecution resulting in heavy fines or even curtailing of freedoms in the extreme cases. Therefore, it’s critical to proceed with caution in this scenario. There is a significant difference between specialists in the field of taxation, and at this point the interpretation and legal protection required makes it a matter for lawyers rather than accountants.

Any final VAT advice?

My recommendation is not to leave anything to chance. Don’t assume you’ll get lucky and avoid being audited. Instead, assume you will need to be prepared for an audit at any moment and manage your taxes with the appropriate level of thoroughness and care.

REAL ESTATE TAX CHALLENGES

Partner Rany Schwartz talks about challenging issues in real estate tax both in Israel and abroad.

Listen to the podcast (in Hebrew) here

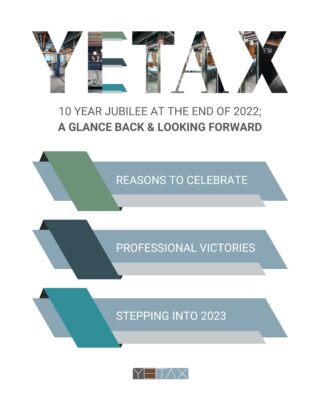

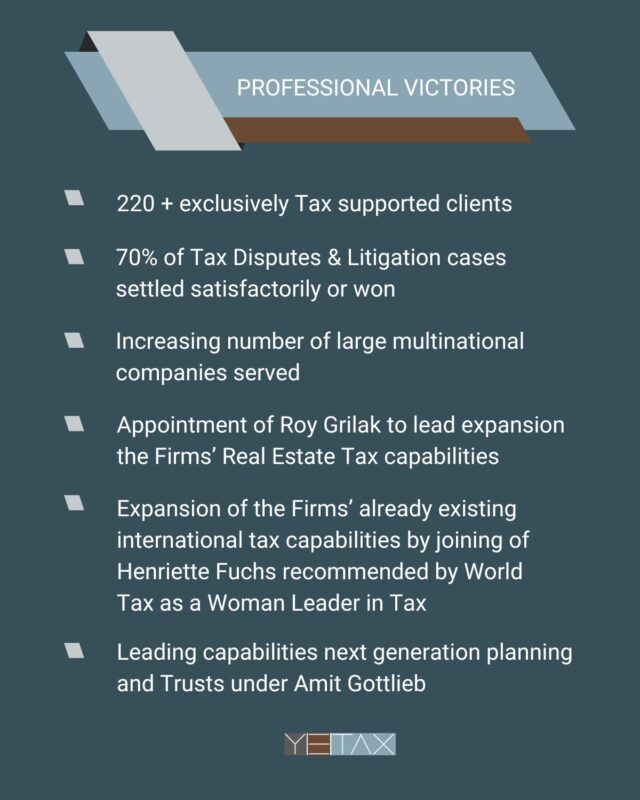

wishing you all a very happy new year

We are excited to take into this New Year the many lessons learned and professional growth achieved across all areas of our Tax expertise, much confidence from our successes and

an energized passion and focus for maintaining our standard of excellence in Tax Law

happy Jewish New Year Wishes from yetax

the largest and excelling tax firm in Israel

Wishing our wonderful friends, clients, colleagues and surrounding neighbors, Peace, Health, Happiness and a Fulfilling 5783, in the New Jewish Year ahead!

- 1

- 2

Dvir was very excited about the excellence and professionalism of the committees and colleagues and very much enjoyed working with so many reputable tax experts, colleagues, from around the world.

On his part, Dvir Saadia represented our firm YΞTAX, leading # 1 tax boutique in Israel, at the exiting discussions of the ‘Private Client Tax Committee’- and the all round ‘Tax Committee’ discussions at IBA.

After much hesitation and concern, Dvir did decide to travel to the conference, abroad, despite the current situation in Israel. Not an easy choice at all for anyone involved.

We, at YΞTAX would like to extend our appreciation to all the magnificent IBA tax & international tax experts who already know us, and for the new friendships that are blossoming and to which we may contribute top Israel tax-support and we are thankful for the the precious assistance we already receive from IBA Tax colleagues in many countries.